Understanding the détaxe VAT refund step by step process can save travelers a significant amount of money. Yet many people miss refunds simply because the system feels confusing. I have helped frequent travelers navigate VAT refunds across Europe, and the process becomes simple once you know what to expect.

In this guide, I explain the détaxe VAT refund step by step in plain English. You will learn who qualifies, how to apply, and how to avoid common mistakes. Whether you are shopping in Paris, Milan, or even planning purchases around travel hubs like Orange Theory Mountain View before an international trip, this article will help you keep more of your money.

What Is a Détaxe VAT Refund?

A détaxe VAT refund allows non-residents to reclaim Value Added Tax paid on goods purchased abroad. VAT is a consumption tax included in retail prices across many countries. Tourists who export goods outside the region can often recover this tax.

The détaxe VAT refund step by step process exists to ensure goods leave the country unused. This rule protects local tax systems while rewarding travelers. Knowing the basics helps you decide if claiming a refund is worth your time.

Who Is Eligible for a VAT Refund?

Eligibility depends on residency, travel status, and purchase behavior. Generally, you must live outside the VAT zone where you shop. You also need to meet a minimum spending amount in a single store, on the same day.

Age requirements may apply in some countries. Items must be for personal use, not resale. When following the détaxe VAT refund step by step, eligibility is always the first checkpoint.

Which Purchases Qualify for Détaxe?

Most physical goods qualify for VAT refunds. Clothing, electronics, cosmetics, and gifts are commonly eligible. Services, hotel stays, and food consumed on-site usually do not qualify.

Some countries exclude certain items like tobacco or fuel. Always ask the retailer before paying. This small step saves time later in the détaxe VAT refund step by step journey.

How the Détaxe VAT Refund Step by Step Process Works

The VAT refund process follows a logical flow. Once you understand the sequence, it feels manageable and predictable.

Shop at Participating Stores

Not all stores offer VAT refunds. Look for signs indicating tax-free shopping. When in doubt, ask before checkout.

At payment, inform the cashier that you want a VAT refund. This ensures the correct paperwork is prepared. This step sets the foundation for the entire détaxe VAT refund step by step process.

Provide Required Identification

You will need your passport to prove non-residency. Some stores may also ask for travel details. Ensure your name matches your passport exactly.

Errors here can invalidate your claim. Accuracy matters more than speed when following the détaxe VAT refund step by step approach.

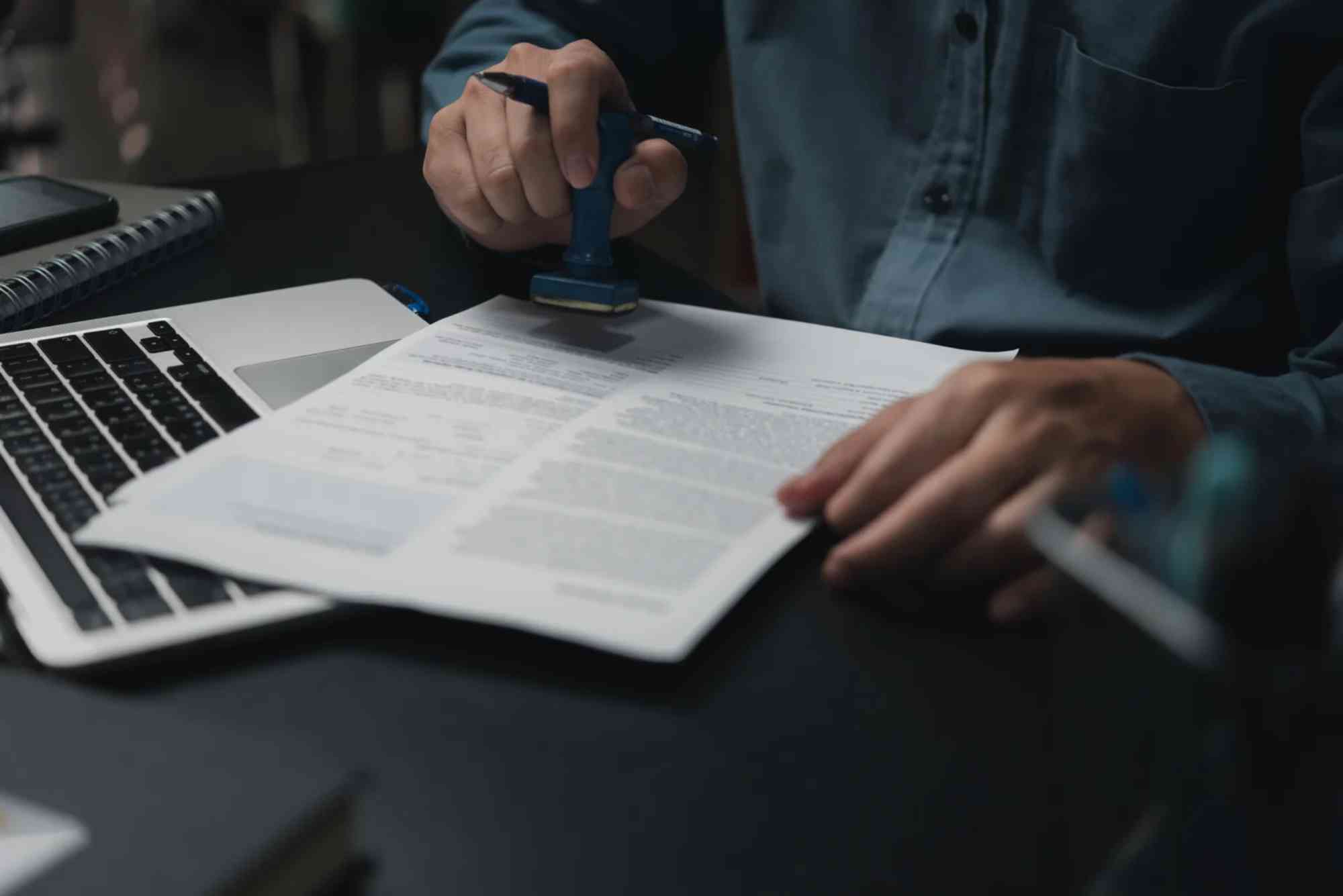

Receive the VAT Refund Form

The store will issue a VAT refund form, either paper or digital. Review it carefully before leaving. Check purchase details and personal information.

Keep this form safe with your receipts. Losing it means losing your refund, regardless of how carefully you followed the détaxe VAT refund step by step process.

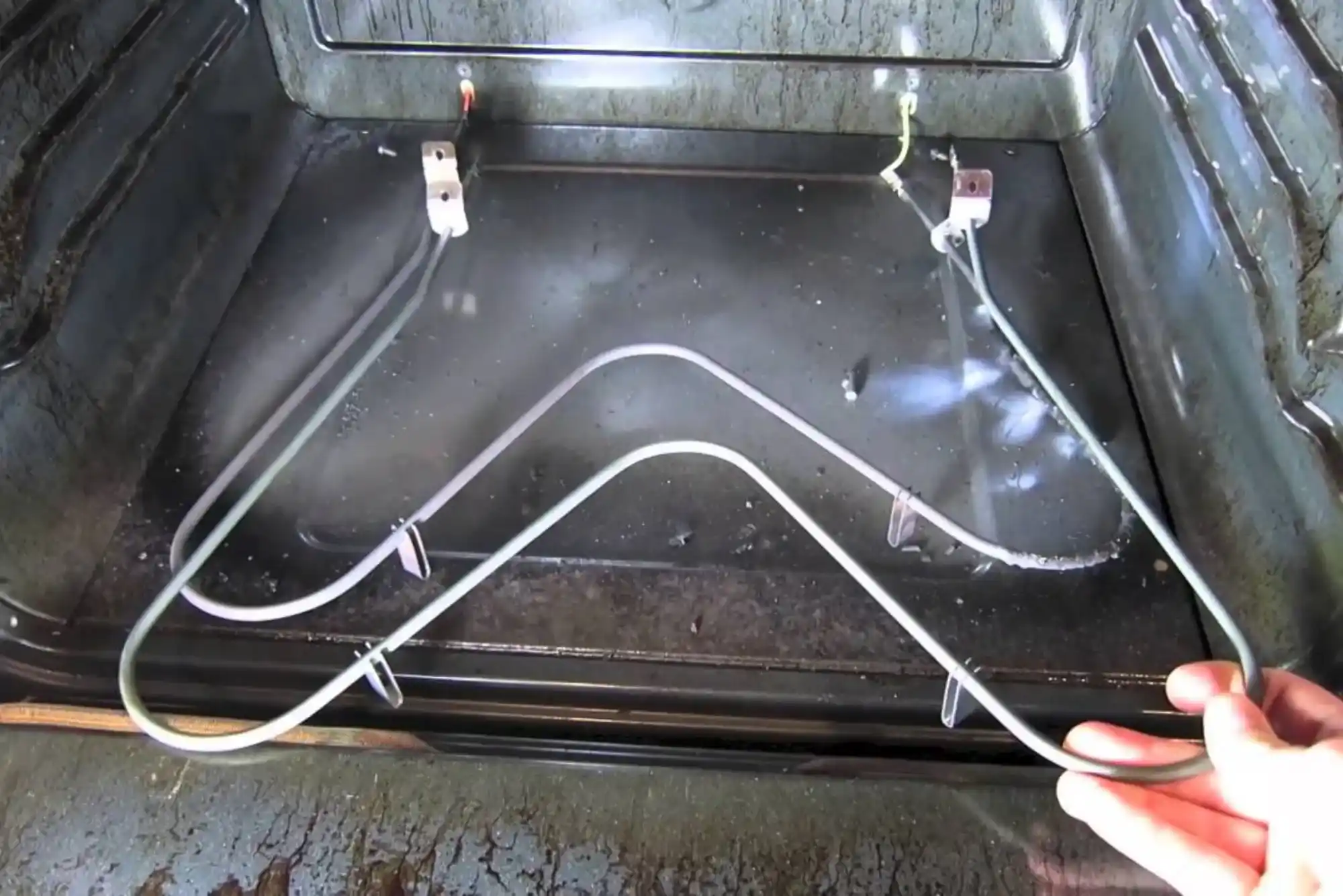

Pack Items Correctly

Goods must leave the country unused. Customs officers may ask to see them. Pack items in carry-on luggage when possible.

This step is often overlooked. Yet it is critical for successful validation during the détaxe VAT refund step by step process.

Validate at Customs Before Departure

At the airport or border, locate the customs VAT desk. Present your forms, passport, and purchased items if requested.

Some airports offer electronic kiosks for validation. Always complete this before checking luggage if items are inside. This is the most important step in the détaxe VAT refund step by step system.

Receive Your Refund

After validation, submit forms to the refund operator. Refunds are issued via credit card, cash, or bank transfer.

Processing times vary. Credit card refunds may take several weeks. Patience is part of the détaxe VAT refund step by step experience.

Common Mistakes That Lead to Lost Refunds

Many travelers miss refunds due to small errors. Forgetting customs validation is the most common mistake. Another issue is arriving at the airport too late.

Incorrect personal details also cause rejections. Always double-check forms. Following the détaxe VAT refund step by step carefully reduces these risks significantly.

Digital VAT Refund Systems Explained

Many countries now use digital VAT refund platforms. These systems reduce paperwork and speed up validation. Stores upload purchase data directly to customs systems.

Digital tools simplify the détaxe VAT refund step by step process. However, travelers must still validate electronically before departure. Technology helps, but attention is still required.

How Much VAT Can You Get Back?

Refund amounts vary by country and product. VAT rates range from about 5% to over 20%. Refund operators deduct service fees.

Typically, travelers receive 10% to 15% of the purchase price. Understanding realistic expectations makes the détaxe VAT refund step by step process feel more rewarding.

Country-Specific Differences You Should Know

Each country applies VAT rules differently. Minimum purchase thresholds vary. Deadlines for export may also differ.

Before shopping, review local rules. This preparation ensures a smooth détaxe VAT refund step by step experience and avoids surprises.

Timing Your Shopping for Maximum Refunds

Shopping closer to your departure date reduces risks. Long stays increase chances of losing forms or missing deadlines.

Plan major purchases near the end of your trip. This strategy aligns well with the détaxe VAT refund step by step timeline.

Is the VAT Refund Always Worth It?

For small purchases, the refund may feel minimal. For luxury items, savings can be substantial. Time investment also matters.

Evaluate the refund value against effort. Experienced travelers quickly master the détaxe VAT refund step by step process, Détaxe VAT Refund Step by Step making it efficient and worthwhile.

Integrating VAT Refunds Into Travel Planning

Smart travelers treat VAT refunds as part of budgeting. Anticipated refunds can offset other travel expenses.

With practice, the détaxe VAT refund step by step process becomes routine. It transforms from a hassle into a financial advantage.

FAQs: Détaxe VAT Refund Step by Step

How do I get a VAT refund step by step?

You shop at a tax-free store, request a VAT form, validate it at customs, and receive your refund after departure.

Can I get a VAT refund if I forgot at the airport?

Usually no. Customs validation before departure is mandatory. Without it, refunds are rarely approved.

How long does a VAT refund take?

Credit card refunds typically take two to eight weeks. Cash refunds are immediate but include higher fees.

Do I need to show the purchased items?

Customs may request to see items. Always keep them accessible until validation is complete.

Is there a minimum purchase amount for VAT refunds?

Yes. Each country sets a minimum spend per store, per day. Check local rules before shopping.

Make the Détaxe VAT Refund Work for You

The détaxe VAT refund step by step system is designed to benefit travelers, not confuse them. With preparation and attention, reclaiming VAT becomes straightforward. Over time, these refunds can add up to meaningful savings.